Energy Markets Briefing note – Winter 21

Why we think gas prices can go up (and why we might be wrong)

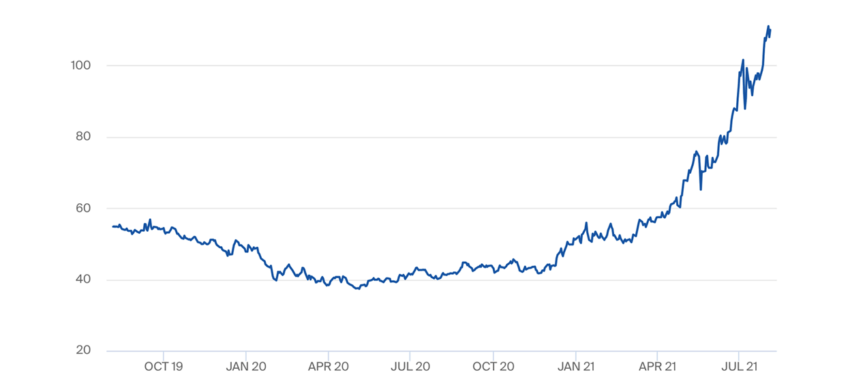

Global gas markets are in uncharted territory which is not surprising considering how tumultuous 2020 was for the world. The gas supply correction last year, following relatively minor gas demand destruction, has had the unintended consequence of a super-tight gas market across the globe in 2021. There is simply not enough gas supply reaching the desperate demand centres throughout the northern and southern hemispheres right now. Japan’s nuclear fleet is struggling to meet soaring air-conditioning demand (“turn up the gas turbines!”); Brazil’s drought-stricken hydro-electric generators need alternative power (“turn up the gas turbines!”); European storage sites need replenishing ahead of winter (“pay up for LNG imports”). Not to mention record breaking gas numbers in China, Spain, Mexico and elsewhere this year. However, should we be looking at this as a short term supply squeeze, caused by a perfect storm of demand hikes coupled with lagging supply?

There are two outcomes from here:

- A continuation of fear and a risk premium which feeds on scarcity, which can carry on as long as consumers have no alternative than to buy more gas to keep the lights and heating on

- A return to more ‘normal’ supply/demand fundamentals and pricing

The European, Asian and US gas markets certainly appear to be pricing in scenario 1, with very real fears that sustained heatwaves, an active hurricane season, and a cold fourth quarter will result in real gas shortages. But what happens if the weather becomes less extreme? What if the heat dissipates in Asia and LNG storage tanks in Tokyo, Jiangsu, Samcheok are all full? What if the Atlantic hurricane season is not like last year (remember, 2020 was a 1 in 100 year event for tropical storms)? What if October and November are warmer than normal in Europe and the US?

If the above ‘return to normal’ scenario develops, coupled with an increase in European imports from Russia in the fourth quarter, then gas, power and carbon prices will surely fall. Perhaps a 50% retracement could be on the cards over the next three to four months – however, this would still leave gas prices at a relatively high level (e.g. December UK gas could ‘collapse’ and lose 50% of its price rise yet still be at 80p/therm).

If scenario 1 is the outcome, and the pattern of extreme weather and unresponsive gas supply continues for the remainder of the year, then the upside to UK, EU, US and Asian gas prices is almost unimaginable. Keep an eye on those weather forecasts.

Please contact [email protected] for further advice

Read next

High performance provides bold new focus for Mitie

An exciting commitment to elevating the performance of the built environment is at the heart of Mitie’s newly revealed corporate narrative. With 72,000 colleagues working across the public and private sectors, and delivery that…

Mitie recognised as UK Top Employer for seventh consecutive year

Mitie, the UK’s leading facilities transformation company, has been recognised as a UK Top Employer for the seventh consecutive year. With a growing workforce of 72,000 colleagues in a competitive market for attracting and…

How we’re using AI to drive facilities transformation

As AI plays a growing role in facilities management, we share how Mitie is putting this transformative technology to use – and what that means for our clients. By Anindya Biswas and Michael Moulsdale…

Mitie partners WalkSafe as people feel unsafe after dark

As Mitie announces its partnership with WalkSafe, the UK’s leading personal safety app, a new survey on perceptions of safety has found that 44% of women and 21% of men do not feel safe…

Skip to content

Skip to content